Obamacare Impact, Pricing Analysis

Our offices have received many calls from clients this week wondering what the real impact would be on health insurance premiums, or more accurately stated, would they save any money!

I want to first state that the price impact analysis is pretty easy, we need to be careful and acknowledge that the new plans will offer some added benefits that are currently not offered in existing insurance policies. Clearly there is a cost to providing extra stuff, and in this case the extra stuff can be pretty expensive. The real issue though is that some people just don't need extra "stuff" as it is pretty hard to argue that a 64 year-old woman needs maternity coverage, but technically, "it's in there". The new law distorts prices and while it attempts to streamline plans and simplify, it really makes things complicated and worst of all it does nothing to control costs as we've lamented hundreds of times in this blog.

With the disclaimer about reality stated upfront, here goes.

Texas Health Design worked with new clients all week that are contemplating our advice which has been to buy a health policy now prior to December 1, 2013 to lock in lower rates which will be kept in place for a one year renewal period. The clients will keep these old "pre-ACA" policies and refuse to opt in to new Obamacare policies on 1/1/2014.

These clients are not looking to start a family right now and do not have any previous metal health issues that make this a concern. They also do not have any pre-existing conditions that might prevent them from obtaining a policy in the underwriting process. These acknowledgments are important as the current health insurance policies offered in 2013 do not offer maternity benefits or in the case of Blue Cross Blue Shield of Texas, don't offer mental health benefits either. Because they don't care about these essential health benefits that will be offered on all new 2014 policies, these clients are willing to look at alternatives to save themselves some money.

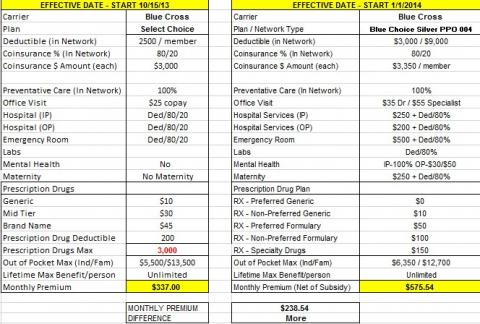

Let's see if they can be successful using our strategy. Below is a summary of two plans that were examined by a great couple named Dan and Dawn. Dan is almost 30 years old and Dawn is 31. (For a clearer image see the graphic above)

Plan Comparison

It's Their Choice

The plan on the right is a current Blue Cross Blue Shield plan called the Select Choice Plan. This plan is a very solid offering that provides unlimited office visits to a primary care physician or specialist with a $25 co-pay. The plan pictured here has a $2,500 deductible and $3,000 of co-insurance. What this means is that in a worst case accident or illness the most that one of them would pay in a calendar year is $5,500 (the combination of the deductible and co-insurance). It has decent prescription drug coverage and is offered for $337/month for this married couple.

The Hope

A similar plan in the new environment is a new Blue Cross offering called the Silver PPO 004. This plan has a $3,000 deductible and $3,350 in co-insurance. In the Silver PPO 004 you may see a primary care physician for a $35 co-pay and a specialist for $55. The Silver plan provides mental health benefits just like any other service and does cover maternity and all pre-existing conditions. In total, the plan is a good one, but requires a greater out-of-pocket outlay in the event of serious health issues. In this case, the worst case maximum cost is $6,350 in a year, which is $850 more than the Select Choice plan. The cost of this new Affordable Care Act compliant plan from Blue Cross is $575.54 a month!

The Reality

While the promise of enhanced benefits and no underwriting may have many excited, we find that there is a cost difference that may be eye-opening to some. The new "Obamacare" policies will cost this young couple close to 70% more each month and will expose them to a higher deductibles and greater out-of-pocket costs. Unfortunately, I don't remember any of those stark realities being explained to the US citizenry in the past four years.

How About The Older Guys?

We've been led to believe that at least the older guys will get a break on their cost and at least someone will see the "affordability" of the Affordable Care Act. Let's take a look, using the same plans as a basis for comparison.

My friend is a 55 year-old woman in the Dallas area. Dottie is a wonderful woman who is healthy and bought a policy from us about two months ago. We re-ran her $2,500 Select Choice plan for a November 1st effective date for this exercise and found that her coverage could be obtained for $534/month.

The Blue Choice Silver PPO 004 would be a plan that Dottie might consider in the new environment and we find that she would be charged $688.42 a month. Now it is nice to know that Dottie would have maternity coverage if she needed it, but I'm not sure she values a plan that forces her to pay 29% more a month in premiums and causes her to pay more in the event of a serious health event.

Is It Possible That Everyone Is A Loser?

I wanted to push this analysis to age 64 to see if ANYONE with good health was a winner here in Texas in moving to an Affordable Care Act compliant plan that was similar to the solid Select Choice Plan.

I re-priced Dottie's Select Choice plan with a $2,500 deductible, but increased her age to 64 years of age with a November 1st effective date. The premium she'd pay if she obtained that plan with her age would be $715 / month.

The ACA Select Choice Silver PPO plan starting January 1st 2014. The results of the pricing experiment revealed that Dottie would need to pay $810.54 / month for a lower quality plan that forced her to pay more out-of-pocket for each physician visit.

Pre-Existing Conditions & The Uninsurable

Ok, let's be realistic, we've written lots of articles about the benefits of the new laws and from the perspective of someone with lots of health issues that have prevented them from obtaining insurance, the ACA might be beneficial. The post "SAVE MONEY, LOSE THE HIGH RISK POOL" highlights exactly what we had hoped we'd see given all the promises from our leaders.

The Cost Of Fear

I spoke with a woman today that had cancer eight years ago and survived and is very healthy. She continues to hold the insurance policy that she had when she was diagnosed and each year they raised the premiums for her coverage. I almost fell out of my chair when she told me that she paid $2,200 a month for her insurance! She has struggled to pay for this insurance and has been fearful to lose it. The horrifying thing is that she could have gone to the Texas High Risk Pool and paid about $750 a month for similar coverage! Shocking!

The promise of the ACA has led us to believe that their will be great relief from the high prices of the High Risk Pool. The truth is that if this lady was in the Texas High Risk pool today like she should be, she would probably save about $100 a month by moving from a policy costing $750 a month to one costing $650. Of course we'll immediately find a solution for her and get her off of the plan she has and then transition her to a plan that is ACA compliant in the next several months. My guess is that she'll save almost $1,500 a month by the time we are done in January. This extreme case is not typical, but a great example of what happens when people don't have trusted advisers to help them examine their choices and are fearful to reach out and find knowledgeable teachers. I am so happy that I heard about her situation and we spoke. What a waste!

The story above underscores that some will benefit but the vast majority of us have been told that we'll save. The President said that we'd save around $2,400 per person each year! Poor people will receive plans that cost more than what they would get if they would have been able to buy policies today, and the taxpayer will simply pay for their new insurance they won't understand or afford (out-of-pocket expenses like deductibles and co-insurance).

And The Winner Is...

An industry that managed to have the government compel you to buy their product at a higher price than what they were charging before the legislation was passed. I'm beginning to see a few news stories publishing the comments of our poor uninsured folks that are figuring out that "free" coverage still requires them to pay out-of-pocket costs, something they never did at emergency rooms and when they were using the county health system services. When a large number of these people realize that they've been promised everything and gotten nothing, watch out.

If you'd like a quote to obtain coverage while it is more affordable than plans under the Affordable Care Act, visit our Get A Quote page, give us a call at 713-422-2935 or simply visit our Contact Us page and let us know when to connect with you. There is still time to lock in good rates, this isn't a sales job, it is simply the facts. We look forward to serving you.

Jason W Bohmann

Texas Health Design

www.texashealthdesign.com

713-422-2935